Preferred Equity Is Pouring Into Multifamily

As traditional lenders hold back on funds and leverage due to rising interest rates, regulatory pressures, and a higher perception of risk, multifamily sponsors are facing significant “gaps” in financing, noted Jacob Feingold, a managing director at Canyon Partners Real Estate. That creates vast opportunities for investors to assist with construction loans, bridge loans, permanent financings and refinancings.

Canyon Partners Real Estate has invested $2.2 billion in preferred equity investments in multifamily over the past decade because of its equity-like returns and debt-like protections.

“Preferred equity investments will generally have certain debt-like characteristics, which may include a fixed term or redemption date, priority repayment of all of its return and principal prior to cash being distributed to the sponsor, as well as control rights,” Feingold said. Preferred equity investments, which are usually subordinate to a third-party mortgage loan at the project level, may also include a profit participation component in certain cases, he added.

REITs, family offices and some foreign investors are among the new entrants in the preferred equity space.

“What we’ve seen in the last 12 to 15 months is that the market has gotten much more fragmented,” said Chinmay Bhatt, senior managing director in, and founding member of, Berkadia‘s JV equity & structured capital group. “New players have entered into the arena, either with dedicated preferred equity vehicles, or a lot of typically opportunistic-type players who have said they want to be more in the credit or preferred equity space (rather than) the joint venture equity space.”

“Obviously, pricing has gotten higher as the interest rate environment has changed,” said Bhatt. “I would say for any given product type you’re 200-plus basis points higher on pricing today than 12 or 15 months ago. What we’re seeing today because of the fragmentation, and, candidly, with it being more difficult for groups to price risk, is that we have to run wider processes to where we’re going to 30-plus qualified groups to really make sure we’re getting the best solution for our clients.”

However, Bhatt noted that there remain deals that offer attractive pricing, namely transactions that can pay a higher current pay rate to the preferred equity. “Deals that maybe have low fixed-rate loans in place, they’re throwing off a lot of excess cash flow and they’re able to use that cash flow to service a higher current pay.”

Traditional preferred equity structures typically allow for a fixed rate of return that is satisfied through a “current pay” from net cash flow, as well as an “accrual rate” to be paid upon a capital event, namely sale or refinancing of the equity stake.

“In June of 2022 we did a preferred equity deal on a construction deal and that was below 10 percent at about 80 percent loan-to-cost, fully accrued, which is a great execution,” said Cody Kirkpatrick, a managing director at Berkadia and a founding member of the firm’s JV equity & structured capital group. “That same deal–same sponsor, same location, if we were taking it out today–is probably 250 to 300 basis points wider, for our best execution,” said Kirkpatrick.

But while preferred equity is a hot new option, it faces competition from other alternate and traditional funding methods.

“From a structural perspective, the primary competitor to preferred equity is mezzanine debt,” said Steve Peterson, a partner at Alston & Bird. “Preferred equity and mezzanine debt fill the same tranche in a capital stack between the mortgage debt and common equity. The primary benefit that preferred equity has over mezzanine debt is that many mortgage lenders prohibit subordinate debt, including mezzanine debt, but allow preferred equity.”

The increased fervor around preferred equity is benefiting investors, too. “The opportunity set for preferred equity capital has substantially increased beyond the players participating in the space, which enables preferred equity investors to maintain high standards for credit selection,” said Feingold.

Multifamily’s lifeboat?

For years now, multifamily’s performance has been “near bullet-proof,” said Peterson. But in the current climate, challenges abound and capital options are fewer. So sponsors who never considered preferred equity before because of the “the perceived dilution of control and attrition to common equity returns” are willing and eager to entertain these offers.

“Even before the recent market challenges, preferred equity was already growing in popularity as a means by which sponsors could free up their own capital and fund property improvements while satisfying loan to value requirements imposed by conventional lenders,” said Peterson. “But now, many investors view preferred equity as a necessity rather than merely an option in formulating a capital stack.”

Of course, taking on preferred equity does not appeal to every sponsor and some are not as needy, but Kimberly Cozza, executive managing director in Newmark’s multifamily capital markets group, is confident that the space has more room to grow.

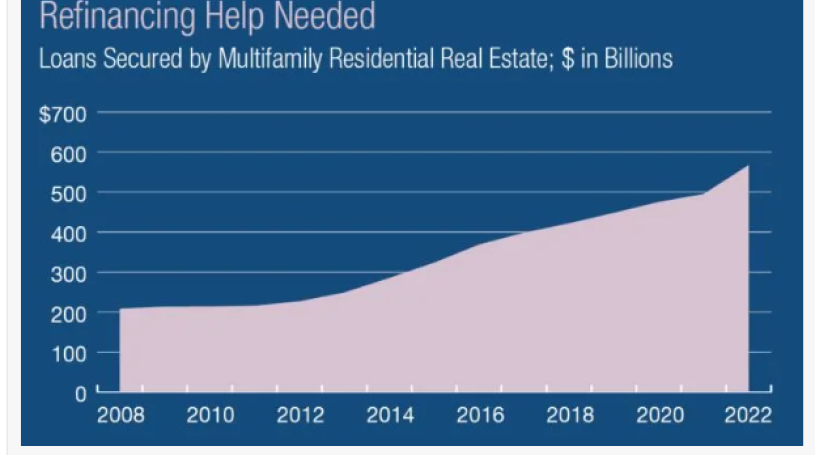

“The continual rise in interest rates, and in some markets softening rents, result in some owners sitting on the sidelines unless they must refinance or sell,” said Cozza. “I would expect an even larger increase in the preferred equity space in the coming year, given the amount of upcoming maturities–over $250 billion in multifamily maturities coming due calendar year 2024, according to data tracked by Newmark’s research team.”

“Preferred equity is being considered across loan structures,” said Cozza, who said that her firm has seen a particular surge in refinancings compared to other years. “Based on the current rate environment, more loans coming near maturity have a gap between the outstanding balance and where the loan underwrites today. Many owners, particularly those in the lowest cap rate markets, would not have the ability to refinance their current debt without coming out-of-pocket or structuring the loan with preferred equity behind it to bridge the gap.”

Read the October 2023 issue of MHN.

Alston & Bird, Berkadia, Canyon Partners Real Estate LLC, Newmark