Madness Or Supply? Canadian Real Estate Prices Don’t Add Up: BMO

Canadian real estate prices are soaring, but the fastest growth is not coming from big cities. BMO chief economist Douglas Porter tells clients to really think hard about this growth. Home prices are now rising even faster than at the peak of the 1980s real estate bubble. Most of that growth isn’t coming from emerging global hubs, but small towns. He asks investors to consider: Do all small towns have supply shortages? Or is the madness of the crowd taking over?

Canadian Real Estate Prices Show Record Growth

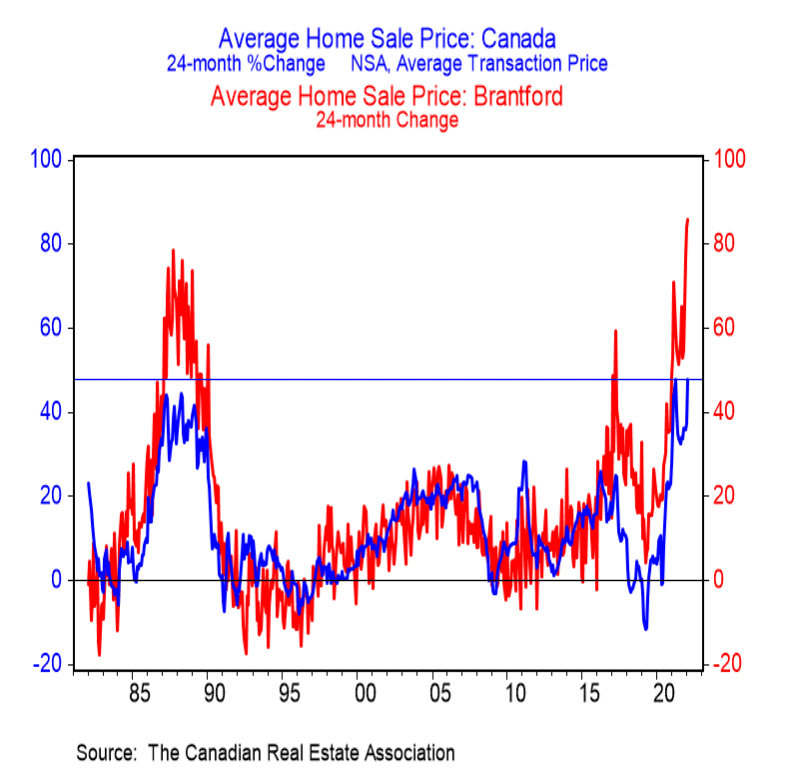

Canadian real estate prices are rising at a record rate, dismissing more supply and higher rates. Annual growth of the CREA benchmark price reached 28% in January 2022, the record for the index. It’s not just a base-effect either, says the bank, with prices up 46.4% since January 2020. Most of this growth also isn’t occurring in emerging global hubs, but small cities in the country.

Canada’s Late ’80s Real Estate Bubble Was Smaller

The CREA HPI only goes back to 2000, so there might be questions about how it compares to the ‘80s bubble. For that, BMO has to use the average transaction price from land registries. “… But even on the somewhat more volatile average transaction price measure, where records go back to 1980, the two-year gain is also a record-hot 48%,” says Porter.

Adding, “In other words, the Canadian housing market has just seen bigger increases than ever witnessed through any two years of the great housing bubble of the late 1980s. Just as a reminder, that episode ultimately saw the overnight rate climb to 14% to quell inflation and bring the market to heel. Prices then went into the wilderness for a decade.”

Those unfamiliar with interest rates might think a 14% climb to be impossible. However, the impact of interest rates is dependent on the sensitivity of the debt. A highly indebted population can see a similar impact with a smaller increase in rates.

If you think it’s different this time due to population growth, one should consider the pace in the 80s. At the height of the late-80s real estate bubble, population growth outpaced today’s recent cycle peak. In 1989, the population growth rate was more than a quarter larger than the 2018-2019 peak. It turns out immigrants stop moving to a place when the value proposition collapses. Shocker, I know.

Is Canadian Real Estate Driven By Madness Or Supply?

Greater Toronto has a gross domestic product (GDP) bigger than most of Canada’s provinces. Steep price growth is arguably justifiable if you’re convinced it’s the next Manhattan. Even if the Government says it’s largely overvalued. However, that’s not where most of the growth has occurred — it’s happening in small cities. These aren’t international hubs, but relatively unknown places to global investors.

“Some of the wildest markets in the country remain smaller and medium-sized cities in Ontario. Not to pick on Brantford, but that fine city—previously known mostly as the home of Wayne Gretzky—has seen prices rocket 86% in two short years,” highlights the bank.

A similar trend can be seen across Ontario’s “cottage country,” where prices rose the fastest. BMO cites Barrie, Welland, Tillsonburg, Woodstock, Chatham, and Guelph as further examples. These are all charming places that might be future global hubs at some point. However, they’re closing the gap between Toronto so fast, they might be killing growth pre-maturely.

The bank rhetorically asks, “Do you seriously believe that each and every one of these smaller centers suddenly suffers from a supply shortage, or could it possibly be that a common demand factor is driving the madness across the entire region?”